UNIT 4

Solved Examples

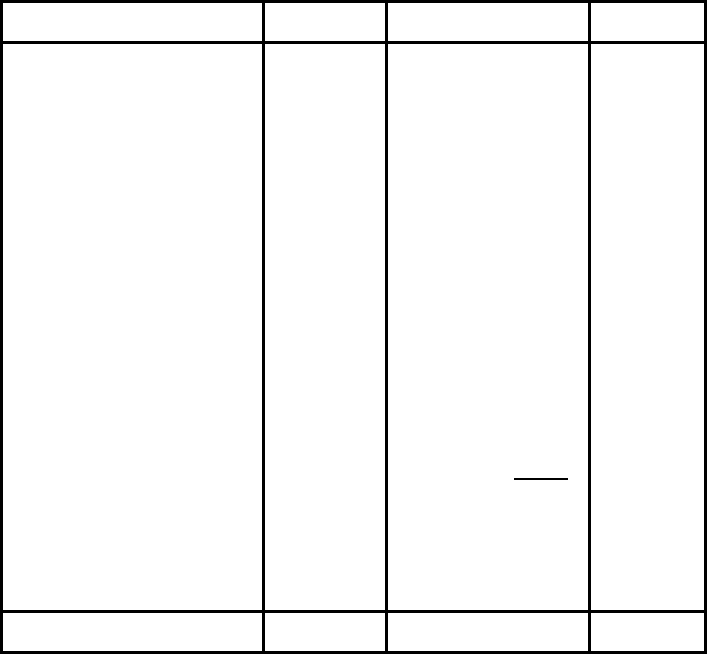

A, B and C share profits and losses in the ratio of 3:2:1 respectively. Their Balance sheet as

on 31/12/2018 is as follows:

Assets

Rs.

Liabilities

Rs.

Capital

Goodwill

20,000

A

1,40,000

Land

40,000

B

1,60,000

Building

2,20,000

C

20,000

Machinery

1,00,000

General Reserve

36,000

Vehicles

56,000

Investment Fluctuation

8,000

Furniture

24,000

loan

C’s Loan

66,000

Investment

36,000

Mrs. A’s loan

30,000

Loose Tools

14,000

Creditors

1,52,000

Bills Receivable

40,000

Outstanding Expenses

40,000

Debtors 80,000

Bills Payable

28,000

Provision 4,000

76,000

Bank Over Draft

1,20,000

Cash

38,000

C’s Current A/c

1,12,000

Profit & Loss A/c

24,000

8,00,000

8,00,000

Adjustments:

1. The partners decided to convert the firm into ABC Ltd. a Joint Stock Company having an

authorized capital of 1,00,000 equity shares of Rs10 each.

2. The purchase consideration was decided at Rs 5,80,000 and settled by paying

Rs 1,00,000 in cash and balance through equity shares.

3. The outstanding expenses were to be settled by the firm.

4. Loose Tools, vehicles, furniture and investments are sold by the firm at Rs 10,000; Rs

50,000; Rs 25,000 and Rs 42,000 respectively.

5. The Partner’s and their spouse’s loan are taken over by the respective partners along

with current A/c balances.

Prepare the ledger accounts in the books of the partnership firm.

Solution: