UNIT 2

Solved Examples

Q.1. (Pay-Back Period- Fixed cash inflows)

A project requires an initial investment of Rs. 2,00,000 and the annual cash inflows of

Rs 50,000 for next 5 years. Calculate the payback period.

Solution:

Initial Investment (cash outflow) = Rs 2,00,000

Cash inflow = Rs 50,000

Pay-back Period = Initial Investment (Cash outflows)

Annual Cash Inflow

= 2,00,000/50,000

= 4 years

Q.2. (Pay-Back Period- Variable cash inflows)

A project requires an initial investment of Rs. 2,00,000 and the annual cash inflows for 5

years are Rs. 60,000, Rs. 80,000, Rs. 50,000, Rs. 40,000 and Rs. 30,000 respectively. Calculate

the payback period.

Solution:

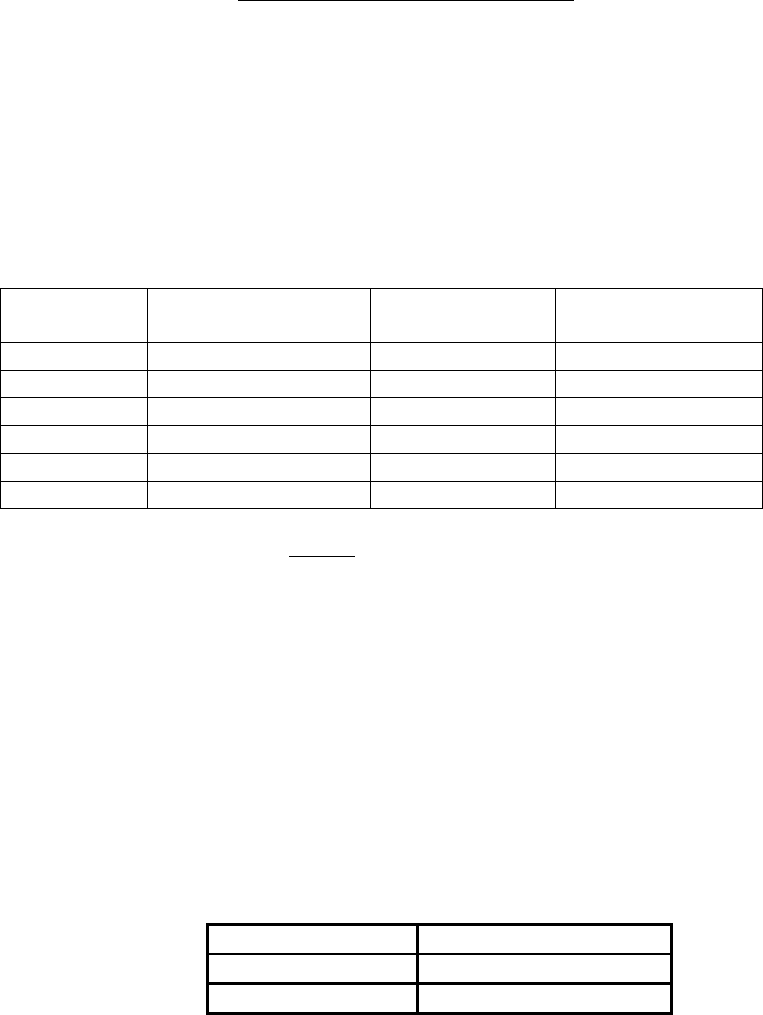

Year

Cash Outflow

(Rs)

Cash Inflows

(Rs)

Cumulative Cash

Inflows (Rs.)

0

2,00,000

1

60,000

60,000

2

80,000

1,40,000

3

50,000

1,90,000

4

40,000

2,30,000

5

30,000

2,60,000

Payback Period = 3 + 10,000

40,000

=3 + 0.25 years

= 3.25 years

For understanding: Cash outflow of Rs. 2,00,000 is recovered in between year 3 and 4(see

cumulative cash flows). Till Year 3, Rs. 1,90,000 was recovered, so Rs 10,000 was yet to be

recovered in Year 4. But Rs 40,000 was total cash flow of Year 4. We need time taken to

recover Rs 10,000 which comes to 0.25 year.

Q.3. (ARR)

A machine is available for purchase at a cost of Rs. 8,00,000. It is expected to have a life of 5

years and have a scrap value of Rs. 1,00,000 at the end of five years period. The machine will

generate the following profits over its life as under:-

Year

Amount (Rs.)

1

2,00,000

2

3,00,000